The Main Principles Of What Is The Average Cost Of Car Insurance In 2022?

Rates were determined by reviewing our 2021 base profile with the ages 18-60 (base: 40 years) applied. Prices for 18-year-old are based on a driver of this age that is an occupant (not a house owner) and also on their own policy. perks.

Washington State currently permits credit history as a rating element, but a restriction on its usage is currently being challenged in the court system (cheaper).

If somebody has an existing insurance plan with AAA (or any kind of other insurance business), they have a 14-day to 30-day grace period to insure their brand-new automobile, depending on the type of plan. If a specific acquisitions a brand-new cars and truck and has never ever had an insurance coverage plan previously, they need to purchase insurance coverage prior to they drive off the lot.

You can additionally utilize the AAA Mobile application to pay your costs. Merely visit as well as, on the residence web page, scroll to Account Actions. Simply below that, under Insurance policy, click on "Pay Your Insurance policy.".

An automobile insurance policy is a contract in between the insurance policy holder, normally the vehicle's primary motorist, and the insurance coverage supplier. The insurance provider consents to secure the insurance policy holder against financial losses detailed within the policy (this is an important note due to the fact that if it's not in the contract, insurance provider will certainly not cover it).

Insurance coverages are those conditions described explicitly in the plan, where your insurance firm will payout. As well as the payout is the quantity up to which an insurance coverage provider will certainly make you entire.

Not known Factual Statements About How Much Is Car Insurance For A 16-year Old In North Carolina?

If the insured stops paying premiums, the insurance policy provider will certainly quit insurance coverage immediately. vehicle insurance. If the uninsured motorist triggers a crash while driving, after that they are directly on the hook for the costs of damages.

Insurance companies supplement that details by collecting huge amounts of data from client claims. Safer cars are typically cheaper to insure, as well as insurance providers commonly supply price cuts to consumers driving safer cars and trucks. Some insurers raise costs for vehicles that have poor security documents and are a lot more prone to harm or resident injury.

The longer an insurance provider insures a type or design of auto, the more data it has to identify reasonable pricing. If the car has constructed a solid record over numerous years, odds are it will guarantee at a practical price, and also stay stable in time - insure. Conversely, vehicles with poor safety and security history or those that are a favored target for burglars will certainly be more expensive to insure.

Insurer have actually discovered that past efficiency often does foretell future results. If you've had speeding tickets or accidents, or other offenses within the last couple of years, your car insurance price might be greater than if you have a pristine driving document. Just how much you drive, Are you a road warrior, or a homebody? The distinction will appear in your premium prices.

It just makes feeling, the more time when driving enhances the possibilities of being included in a collision or sustaining damages to your vehicle. Size issues, You might believe smaller sized automobile, smaller insurance premium. Yet not so quick. In a crash, larger lorries often tend to fare better as well as maintain passengers more secure than smaller lorries.

Anti-theft gadgets, If your automobile has an alarm, a monitoring device to assist cops recover it, or one more theft deterrent, it's much less attractive to burglars, and less costly to insure, as well (cheapest car). Your credit rating, Research has shown that great credit report is linked to excellent driving and also vice versa. Specific credit scores details can be predictive of future insurance coverage claims.

Indicators on Auto Insurance For Trucks: How Much Is Truck Insurance? You Need To Know

car suvs cheapest car insurance accident

The bottom line: Excellent credit rating can have a favorable influence on the price of your auto insurance coverage. Your age, sex, gender as well as marriage standing, Accident prices are higher for all motorists under age 25, specifically single males. Insurance policy rates in a lot of states show these distinctions. If you're a trainee, you might also be in line for a price cut.

Where you live, Usually, due to greater prices of criminal damage, burglary, and accidents, metropolitan motorists pay more for auto insurance than do those in small communities or backwoods. You likely can't easily transform where you live, yet if you do live in a high insurance policy area make certain to pay attention to the other factors that you can control - insurance company.

By doing some research in advance about possible car insurance coverage prices, you can make an educated decision to ensure you have the right vehicle at the ideal rate of owning it. See if ERIE can Offer a Cheaper Car Insurance Coverage Rate, Ready to learn more about budget friendly vehicle insurance policy from ERIE? Check out our and start a cars and truck insurance coverage quote today.

If you want finding an insurance agent in your area, click on the "Agent, Finder" link any time to head to that search device. If you want finding a representative that stands for a certain firm, you can additionally click the business name in the premium comparison which will certainly connect you to that business's internet site - car insured.

Automobile insurance coverage sets you back an average of $1,202 each year, according to a 2020 record by AAA. That claimed, the cost of your insurance policy costs is identified by numerous aspects, so it may be higher or reduced than average. Right here's what you must learn about just how much cars and truck insurance prices and what can impact your plan premiums (cheaper cars).

This standard is based on national data, which takes into consideration everyone from teen vehicle drivers to knowledgeable and also accident-free drivers. auto insurance. Depending on where you live, how much time you've been driving, just how much you drive, your age and sex and a number of other elements, the premium you're charged might be very various.

The Best Strategy To Use For J.d. Power Auto Insurance Study Finds Steady Satisfaction

State and Area, Car insurance is regulated at the state level, and also rates can vary by state and also even by ZIP code. To put it simply, the precise area of your house can have a major impact on your regular monthly costs. For example, the occurrence of criminal damage, burglary and mishaps is higher in city locations than in backwoods.

Driving Record, Tickets and other infractions can spike your auto insurance policy rate because they're an indication that you might be a dangerous chauffeur - insurance. Crashes, mostly when you're at mistake, can also create your premium rates to balloon. In some instances, you can see a rate increase after an accident also if you were not at fault for the mishap but still sued.

cheap insurance cars automobile cheapest car insurance

Car Type and Use, The kind of car you drive is a crucial consideration for insurance companies (cheap car). Cars that are statistically much more likely to be swiped might lug higher prices than others that are further down the checklist. And also the extra costly the car, the a lot more costly the prospective insurance claims, which makes it most likely that you'll have a higher regular monthly premium.

cheaper car insurance car insurance insurance car

auto insurance cheaper car cheaper insurance

Just how you use the automobile is likewise vital. You'll commonly share the number of miles you anticipate to drive yearly as well as the primary use. For instance, if you have a lengthy commute, you might be most likely to get into a crash than someone that largely drives on the weekend breaks for pleasure.

Demographics, Insurance coverage service providers utilize a lot of data to determine danger profiles, consisting of demographics such as age, sex and also marriage status. cheaper cars. Single males under 25 are the most likely to get in a mishap, and they can expect their insurance prices to mirror that raised degree of risk.

Also where it's not required, you have to supply proof that you're monetarily geared up to pay for problems if you cause a crash. If your car is financed, your loan provider may require you to bring a certain degree of insurance above the lawful minimum. If you obtain in a mishap where the other celebration is at fault and also they either don't have insurance or their liability defense is insufficient, this coverage kicks in to assist your policy bridge the void.

This type of insurance coverage is not offered in all states (suvs). Some insurance companies will additionally give extra protection kinds, such as rental automobile reimbursement and emergency situation roadside help. Along with the coverage amounts you pick, insurers will additionally consider your deductible. This is the quantity you'll pay out of pocket prior to your insurance coverage kicks in when you file a claim.

Various other Variables, While not as prominent in the decision, there are a number of other variables that an insurance coverage business might think about when identifying your rate, consisting of: Profession, Housing scenario, Previous insurance coverage (especially, whether there's been had a space in coverage)Driving experience, Discount rate eligibility.

An automobile insurance plan can consist of a number of different sort of insurance coverage. Your independent insurance representative will certainly give expert advice on the type as well as quantity of car insurance protection you ought to need to fulfill your individual requirements and also follow the laws of your state. cars. Right here are the primary kinds of insurance coverage that your plan may consist of: The minimal protection for bodily injury differs by state and also might be as low as $10,000 per individual or $20,000 per mishap.

If you injure someone with your automobile, you could be sued for a lot of money. The amount of Responsibility protection you lug ought to be high enough to safeguard your assets in the occasion of a mishap - vehicle. Many specialists suggest a restriction of at the very least $100,000/$300,000, but that may not suffice.

8 Easy Facts About How Much Does Car Insurance Cost By State? - Progressive Explained

affordable low cost auto affordable car insurance car insurance

If you have a million-dollar home, you could lose it in a legal action if your insurance policy coverage wants. You can get extra coverage with an Individual Umbrella or Personal Excess Liability plan. The better the worth of your assets, the much more you stand to lose, so you need to get responsibility insurance policy suitable to the worth of your properties.

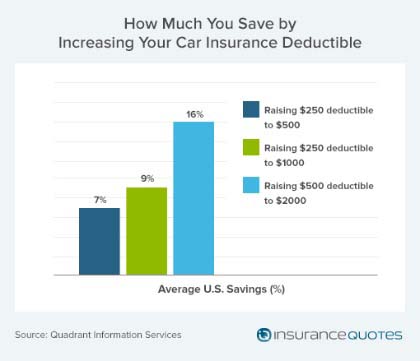

You do not need to figure out just how much to purchase that relies on the lorry(s) you guarantee. You do require to make a decision whether to buy it and also exactly how huge an insurance deductible to take. The higher the deductible, the reduced your costs will be. Deductibles normally range from $250 to $1,000.

If the vehicle is just worth $1,000 and the deductible is $500, it might not make good sense to buy crash insurance coverage - insurance. Collision insurance policy is not usually required by state legislation. Covers the expense of various problems to your car not brought on by an accident, such as fire and also burglary. Similar to Collision coverage, you need to pick a deductible.

Comprehensive coverage is typically marketed along with Collision, as well as both are frequently referred to with each other as Physical Damage insurance coverage. If the auto is leased or funded, the leasing firm or loan provider might need you to have Physical Damage insurance coverage, although the state law may not need it. Covers the cost of treatment for you and also your guests in the occasion of a mishap.

If you select a $2,000 Medical Expenditure Restriction, each passenger will have up to $2,000 insurance coverage for clinical claims resulting from an accident in your vehicle. If you are involved in a crash and the other motorist is at mistake but has too little or no insurance, this covers the gap in between your costs and also the other chauffeur's protection, as much as the limits of your coverage (vehicle insurance).

https://www.youtube.com/embed/kHQVNVgVzD8

The limitations required and also optional limits that may be readily available are set by state legislation. This protection, called for by regulation in some states, covers your medical expenses and those of your passengers, despite who was liable for the accident. The limitations called for and also optional limitations that might be available are established by state legislation.